Select Subject

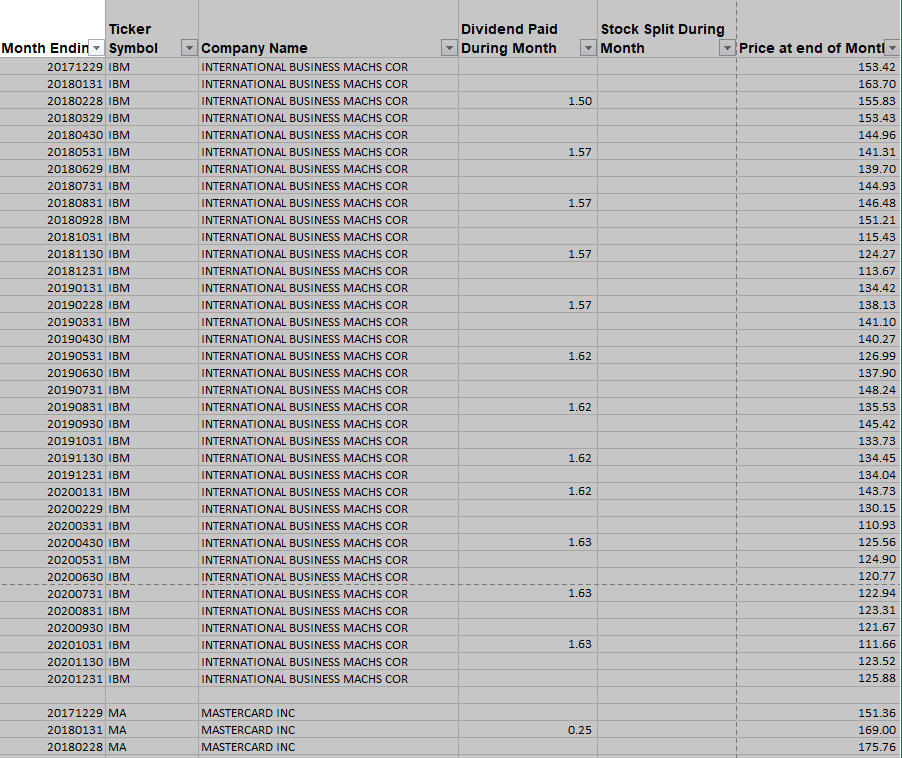

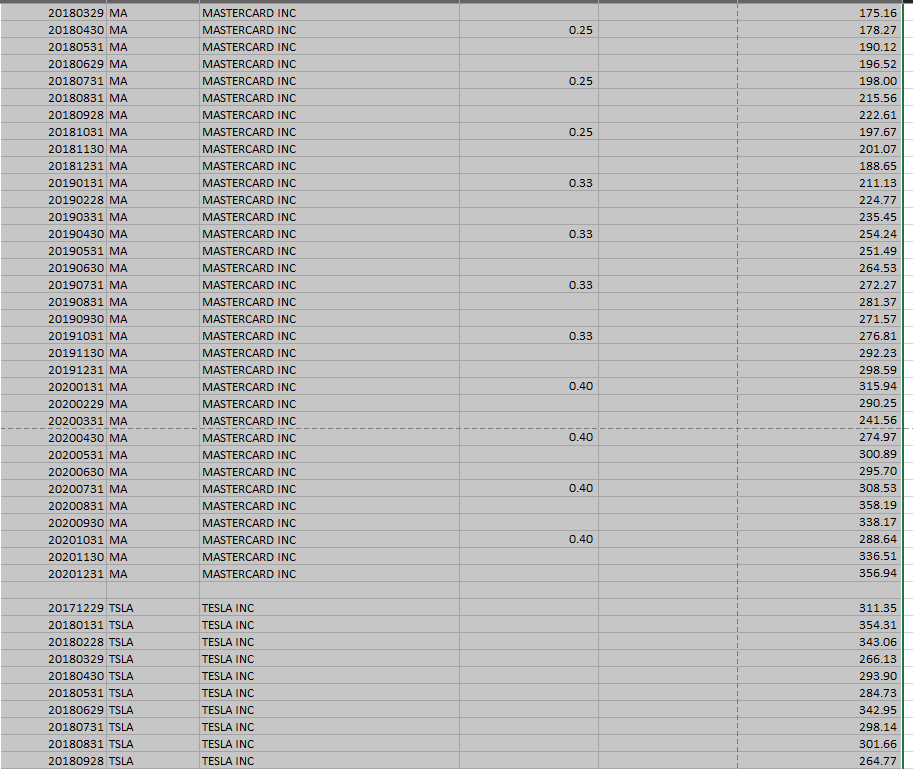

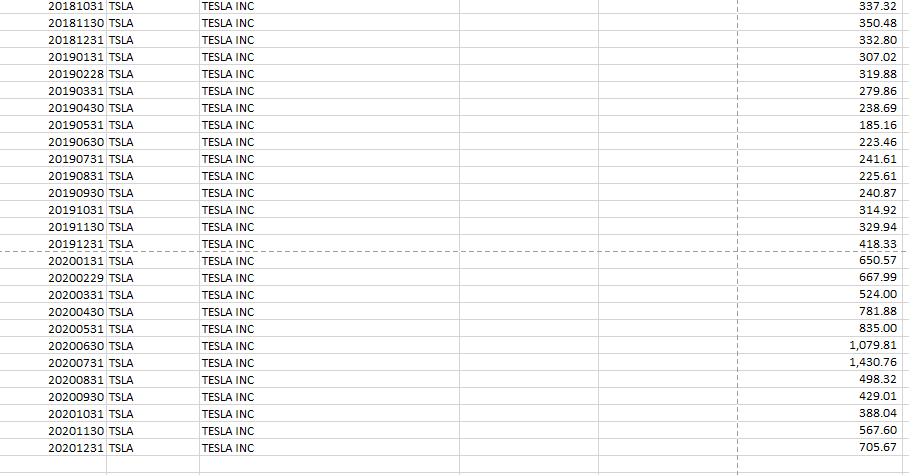

Calculate the monthly returns for each of the stocks: a. Calculate the arithmetic average monthly return for each stock. (3 points) b. Calculate the geometric average monthly return for each stock. (3 points) c. Calculate the monthly return standard deviation for each stock. (3 points) d. Calculate the total percentage return (referred to in the text as the holding period return) for each stock based on purchasing a share at the end of December 2017 and holding it through the end of December 2020. In your calculations assume that any dividends are reinvested immediately in the stock rather than being stuffed under a mattress where they would earn no further returns. (3 points) e. If you constructed a portfolio at the end of December 2017 consisting of 100 shares of each stock and held this portfolio through the end of December 2020 (again, reinvesting all dividends), what would be the total percentage return on the portfolio? What would the portfolio’s geometric average monthly return be?

Support

Support Trending

Trending  Get App

Get App